Convergence of Exponentials

In 1965, Gordon Earle Moore, then director of R&D at Fairchild Semiconductor, discovered a wondrous phenomenon. Moore observed that the number of components (transistors, resistors, diodes, or capacitors) in a dense integrated circuit had doubled approximately every 18 months. He speculated that it would continue to do so for the next ten years.

In 1975, he adjusted the forecast rate to approximately two years (and this projection would hold true for more than half a century). Simply put, this meant that computers would double their capability while their cost remained fairly static.

Moore’s Law is responsible for the fact that your smartphone is many orders of magnitude faster, cheaper, and smaller than the computers that took us to the moon.

20 years later, in the 90s, Ray Kurzweil, the director of engineering at Google, asserted that once a technology becomes digital – meaning it can be programmed in the “1’s and 0's” – it hops on the back of Moore’s Law and begins accelerating exponentially. (Kurzweil calls this the “law of accelerating returns”).

A short list of the highly leveraged and scalable technologies currently accelerating at this exponential rate includes some which are revolutionary– and potentially evolutionary. Think 3D printing, artificial intelligence (AI and AGI), augmented reality (AR), bio-technology, Internet of Things (IoT), nano-technology, quantum computing, robotics and autonomous vehicles, virtual reality (VR) and, of course, distributed ledger technology or blockchains).

These previously independent waves of exponentially accelerating technology are beginning to converge with other waves of exponentially accelerating technologies (EATs).

When a new technology or innovation creates a new market and devours an existing one, we call it a “disruptive innovation”. The more exponential technologies converge, the more their potential for disruption grows exponentially. Single EATs disrupting products, services, and markets – like when Netflix obliterated Blockbuster – while convergent exponentials wash away products, services, and markets, as well as the structures that support them.

Mind the Gap

In my 10+ years in crypto, there have been rare moments when new technology has enabled a whole new set of use-cases that were never possible before. In my experience, the gap between a unique new technology, and its actual application and use, is vast. But on rare occasions, you hear about a new technology, or a combination of existing technologies, that sparks an endless stream of new use-cases that people will soon be able to utilize. That’s what happened when I first met the Odsy Network team.

The Missing Piece Of Crypto

In his 2008 whitepaper, “Bitcoin: A Peer-to-Peer Electronic Cash System”, Satoshi Nakamoto essentially solved the long-standing computational puzzle called the “Byzantine Generals’ Problem”. This states that communication which requires consensus on a single strategy, from all members within a group or party, cannot be trusted or verified. “Nakamoto Consensus” was a breakthrough innovation that enabled this decentralized cooperation in a “trustless” manner, and introduced the concepts of private and public key cryptography to the general public. The private key enables individuals and organizations to self-sovereign their finance, and the fast growth of self-custody wallets started with Metamask. The problem? The trade-off between autonomy and the risk/responsibility of self-custody. Many prefer to surrender this responsibility to centralized custodians (out of fear of managing their own keys), as there is no “undo button” once a transaction is finalized. But centralized custodians are not immune to hacks and, unfortunately, there are many examples of this.

For these reasons, current solutions pose a significant risk to people involved in self-custody of large amounts in crypto.

Crypto is heading towards vertcal-specific blockchiains and operating across them is a growing challenge. Consumers and, especially, businesses, mainly rely on centralized solutions for digital asset custody.

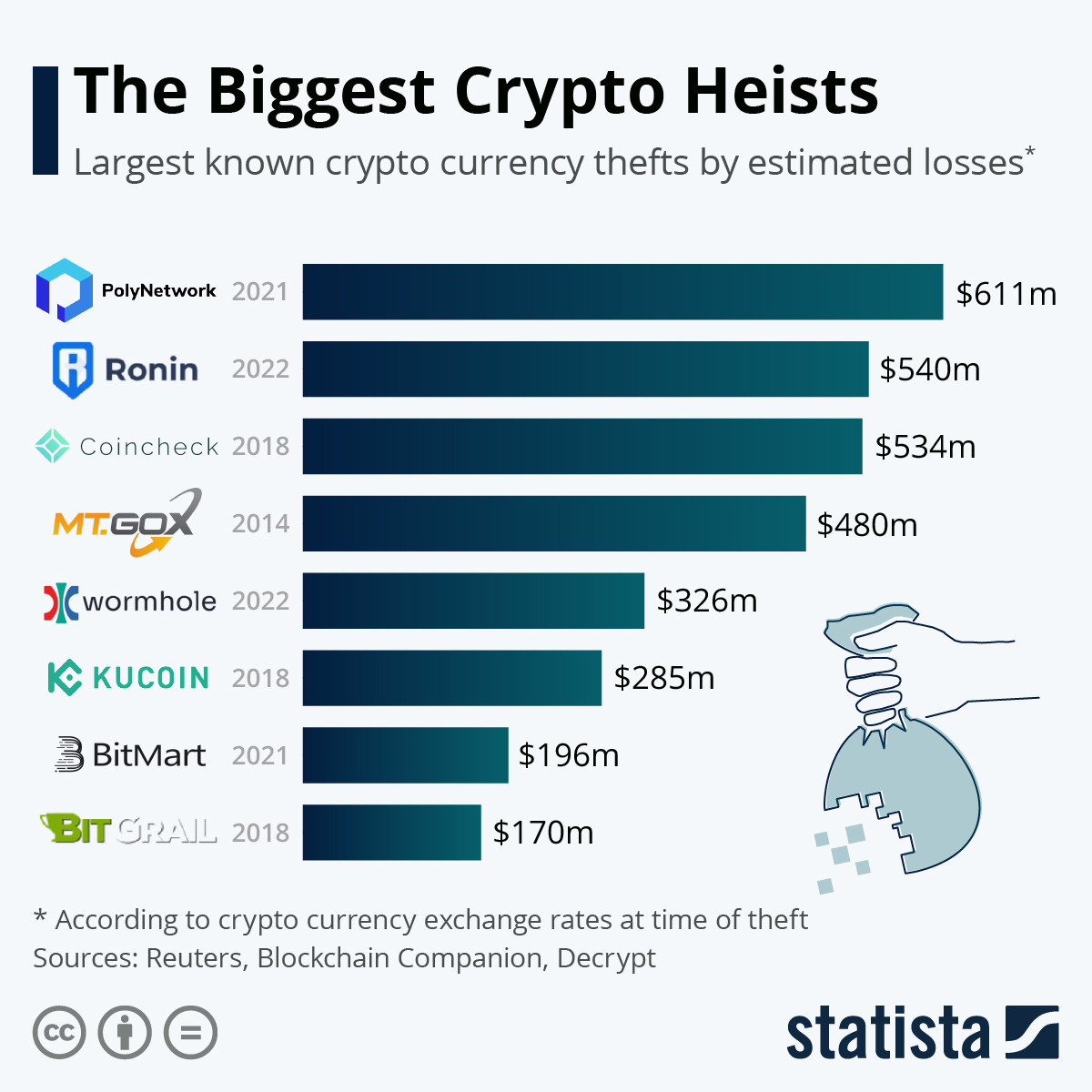

The siloed nature of blockchains gave rise to bridges, but this, in turn, has introduced another security challenge. The risks involved with bridges have come to the public’s awareness with Crypto-Bridge hacks reaching over $1 billion in little over a year. One of the recent victims was Axie Infinity’s Ronin Bridge – which was built to handle surging demand from Axie gamers.

Odsy (pronounced Odyssey: od-uh-see) is a security first, decentralized multi-chain, multiple-party computation (MPC) network and ecosystem, powered by a new blockchain primitive called dWallet, built by the world’s best cryptographers.

Introducing dWallets

A dynamic decentralized wallet, or dWallet, is a multi-chain account (private and public keys) that resides on the blockchain. A dWallet can sign transactions on other blockchains. Authorization to use the dWallet is granted based on rules, multi user approval, etc. dWallets are among the first implementations of direct multi-chain interoperability that function without using bridges, wrapping, or custody.

Thanks to an innovative solution – a wallet to manage dWallets – interacting with multiple chains no longer requires multiple wallets and complex private key management. A single wallet will be able to control any number of dWallets. dWallet ownership can be securely transferred, shared, or divided. Rule-based access to dWallets is managed on a single wallet that supports complex real-world use cases.

At our initial introductory call, I could only imagine a set of use cases around decentralized custody. But then every day I woke up with another use case that I just couldn't wait to use and see people developing on top.

The idea of a tradable, liquid private key enables endless use cases – from various illiquid assets, such as vested tokens, to a portfolio of NFTs. But the real fun actually starts when you begin to imagine all the possible multi-chain applications. One of many examples is that, for the first time, people will be able to transfer their actual Bitcoins (not WBTC) on another chain, or create real, simple cross-chain applications without the risks involved with today’s existing solutions. For much more in-depth information, and many use-cases, you can read the freshly minted Litepaper.

We couldn't be more proud to lead the Odsy pre-seed round with our friends at DCG, and other leading investors joining the round such as Lightshift, Collider Ventures and many more. We’re excited to be backing Omer, David, Sean, and Yehonatan in their long-term vision to change the value transferred and secured on the blockchain.

Want to share thoughts?

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice